The Only Guide for Paul B Insurance Medicare Insurance Program Huntington

Health and wellness intends pay defines amounts for medical costs or therapy and they can offer many options as well as vary in their methods to insurance coverage. For aid with your certain issues, you may intend to speak with your employers advantages department, an independent expert advisor, or contact MIDs Customer Services Department. Buying wellness insurance coverage is a very crucial choice (paul b insurance medicare advantage plans huntington).

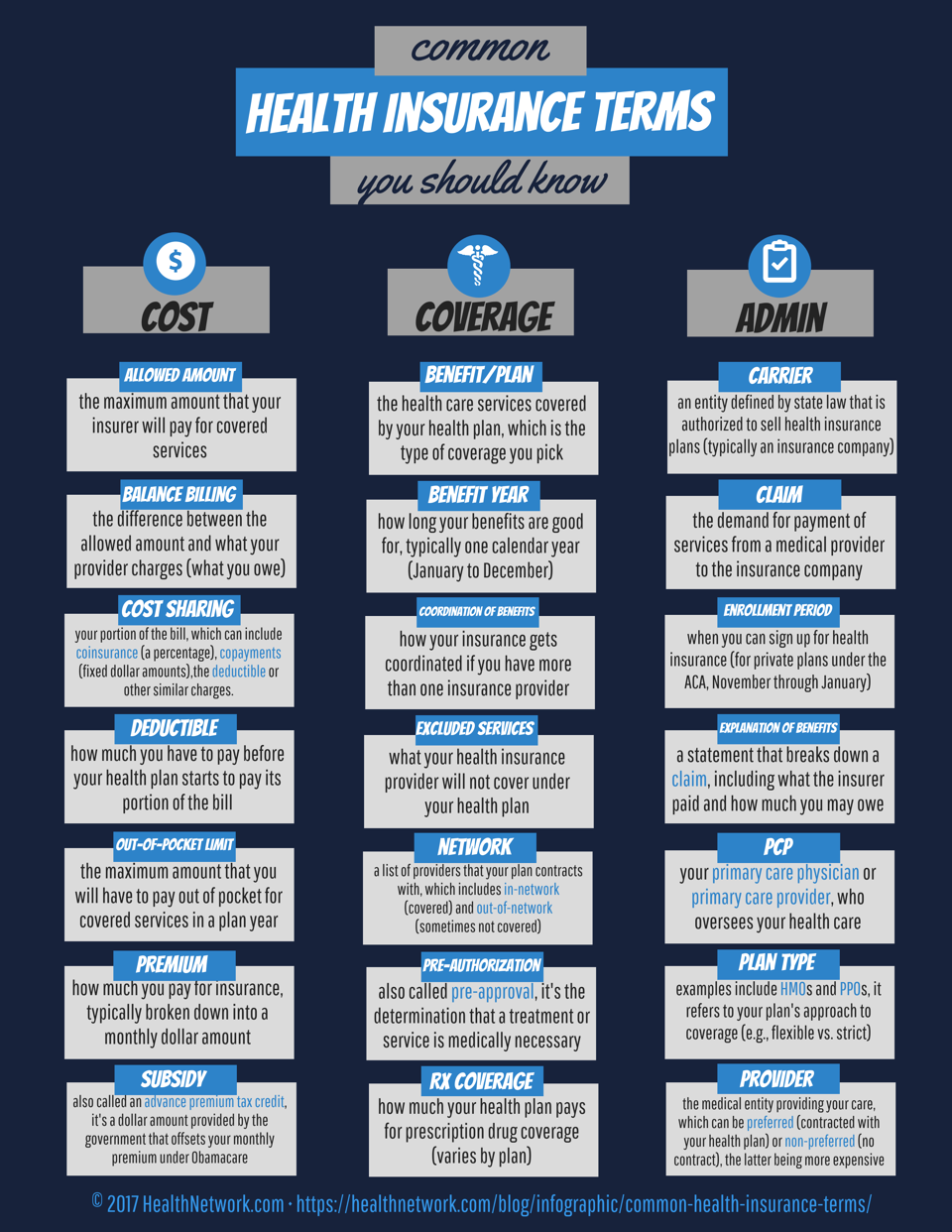

Several often tend to base their whole insurance coverage acquiring decision on the costs amount. As acquiring an excellent worth, it is also really essential that you deal with a company that is economically steady. There are numerous different type of health insurance. Standard insurance policy typically is called a"cost for solution "or"indemnity"plan. If you have typical insurance, the insurance firm pays the bills after you obtain the solution. Managed treatment strategies use your regular monthly

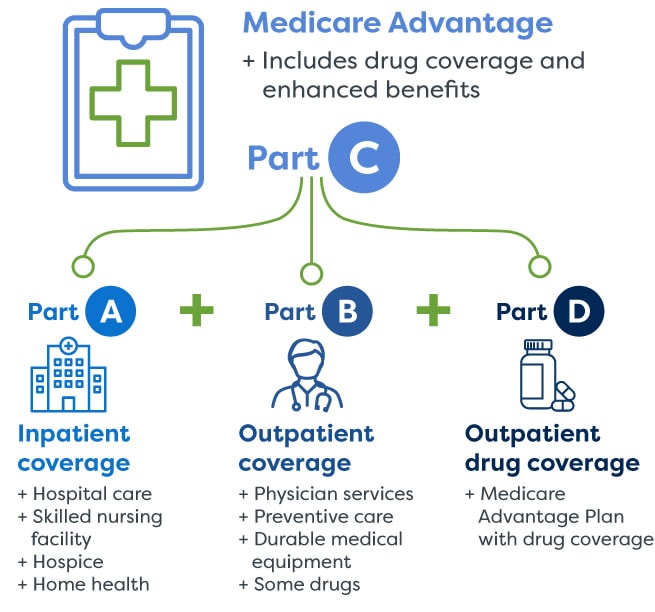

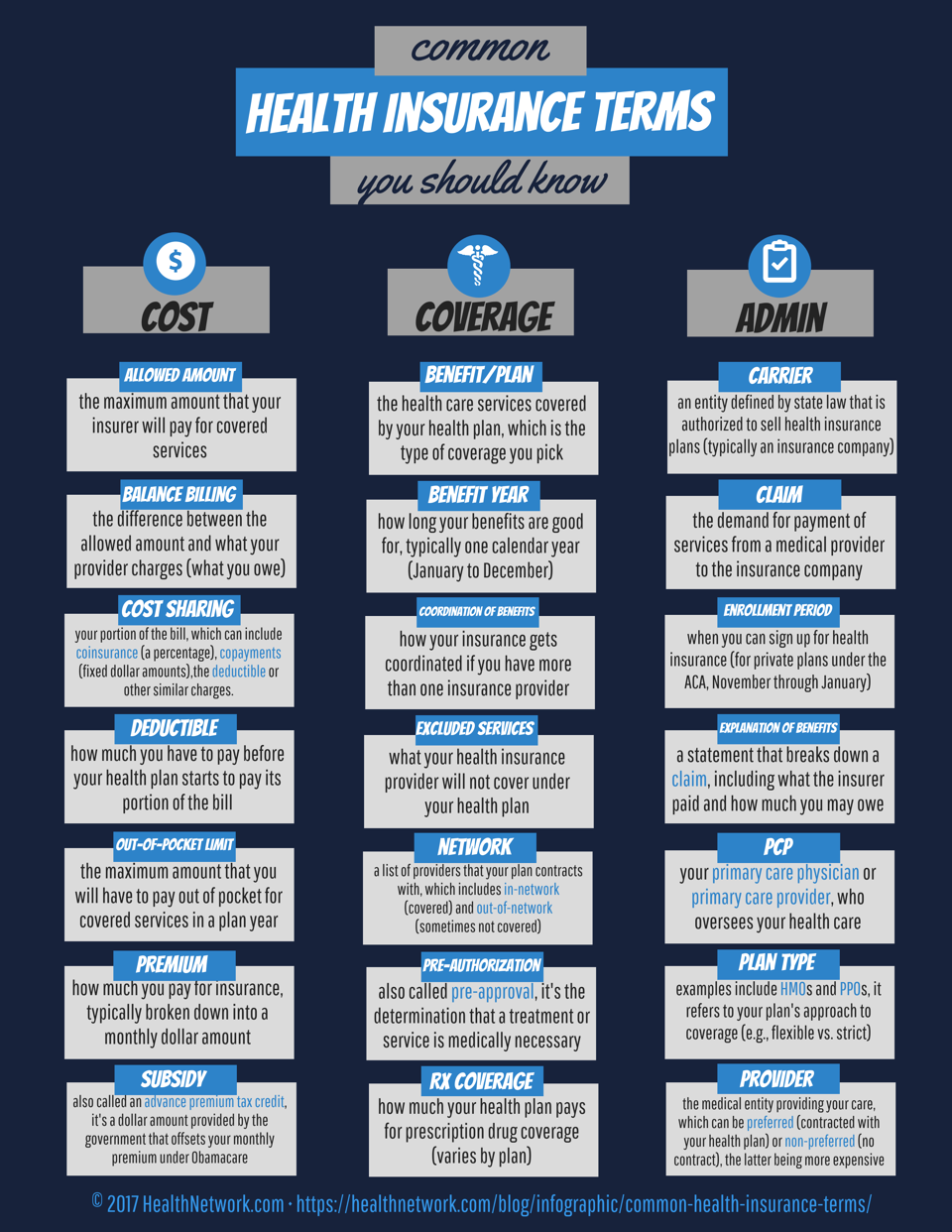

settlements to cover the majority of your medical expenditures (paul b insurance local medicare agent huntington). Health Maintenance Organizations(HMOs) as well as Preferred Company Organizations(PPOs )are the most common managed treatment companies. Taken care of treatment plans urge and also in some cases need consumers to utilize medical professionals and also hospitals that belong to a network. In both standard insurance coverage and took care of treatment strategies, customers might share the expense of a solution. This price sharing is.

commonly called a co-payment, co-insurance or insurance deductible. Various terms are made use of in discussing health and wellness insurance coverage. "Providers"are doctors, healthcare facilities, drug stores, labs, immediate care centers and also various other health treatment facilities and specialists. Whether you are considering enrolling in a standard insurance policy plan or took care of treatment strategy, you must understand your

legal civil liberties. Mississippi regulation requires all insurance providers to plainly as well as truthfully reveal the following info in their insurance policies: A total checklist of items and services that the wellness care plan spends for. State regulations limit exactly how lengthy pre-existing condition exclusion durations can be for private as well as team health insurance plan. If you have a team health insurance plan, a pre-existing condition is a health condition for which medical guidance, diagnosis, care or therapy was advised or obtained within 6 months of signing up witha plan. If you have a specific plan, a pre-existing condition is a health and wellness problem for which clinical guidance, diagnosis, care or treatment was recommended or received within 12 months of joining your plan. Your strategy may refuse to pay for services connected to your pre-existing problem for 12 months. You might not have to this post serve a pre-existing problem exemption period if you have the ability to get debt for your health and wellness treatment insurance coverage you had before you joined your brand-new plan. Ask your strategy for even more information. Your health and wellness insurer must restore your strategy if you want to renew it. The insurance provider can not terminate your plan unless it takes out of the Mississippi market totally, or you commit fraud or misuse or you do not pay your premiums. All health treatment plans should have created procedures for receiving and also solving problems. Grievance procedures need to be consistent with state law demands. If your wellness insurance provider has actually refused to spend for healthcare solutions that you have received or wish to get, you can know the exact contractual, medical or various other factor why. If you have a problem about a health and wellness insurance company or an agent, please describe our Documents an Issue Web Page. However, keep in mind that when you are contrasting business as well as asking for the variety of complaints that have actually been submitted against a firm, you have to be conscious that usually the firm with one of the most plans active will have more grievances than companies that just have a few plans in place. Every managed care plan must file a summary of its network of carriers and just how it sees to it the network can give health and wellness treatment solutions without unreasonable delay. In some cases, a physician, medical facility, or other healthcare facility leaves a taken care of treatment strategies network. When this takes place, a handled care plan have to alert you basics if you saw that supplier regularly.

Every managed care plan have to keep close track of the top quality of the health and wellness treatment services it gives. page Every managed care plan ought to adhere to certain treatments if it establishes that a health and wellness care solution was not medically essential, effective, reliable or ideal.: who may not yet have a full time task that provides health and wellness benefits should be mindful that in an expanding number of states, single grown-up dependents may be able to proceed to obtain health insurance coverage for an extended duration( ranging from 25 to 30 years old)under their parents 'wellness insurance policies even if they are no much longer complete time pupils.

:max_bytes(150000):strip_icc()/difference-between-universal-coverage-and-single-payer-system-1738546.FINAL-be2d0b3e41224890b0d379d231e79dcc.jpg)